Look, I’m going to be honest with you. When I first heard about the Nepal Rastra Bank’s latest monetary policy announcement, my immediate thought was: “Here we go again, another financial reshuffle that’ll probably sail right over most people’s heads.” But then I dug deeper, and honestly? This one’s actually a game-changer for your wallet—whether you’re saving, borrowing, or just trying to make sense of where Nepal’s economy is heading.

So grab your coffee (or chiya, let’s be real), and let’s break down what NRB’s doing with interest rates and why you should actually care this time.

The Big Picture: NRB’s Interest Rate Decision

Here’s the deal. The Nepal Rastra Bank monetary policy for 2025/26 isn’t just tweaking numbers on a spreadsheet somewhere in Baluwatar. Instead, they’ve slashed the policy rate, adjusted the bank rate, and basically sent a clear message to commercial banks: “Hey, it’s time to loosen up and get money flowing again.”

What are the key changes in NRB’s new monetary policy regarding interest rates?

The central bank has reduced its policy rate—the benchmark that influences everything from your home loan to your fixed deposit returns. Essentially, we’re talking about a deliberate move to stimulate credit growth and, hopefully, kickstart economic activity that’s been somewhat sluggish.

Think of it like this: NRB is essentially turning down the “expense dial” on borrowing money. Consequently, when the policy rate drops, commercial banks can access funds more cheaply from NRB, and theoretically, they pass those savings on to you and me.

Understanding the NRB Rate Cut Numbers

How much has the Nepal Rastra Bank reduced its policy rate in 2025?

The NRB policy rate reduction isn’t just cosmetic. Rather, the central bank has made meaningful cuts that financial analysts are calling one of the more aggressive monetary easing measures in recent years. While the exact percentage varies depending on which rate we’re discussing (repo rate, bank rate, policy rate), the overall trend is unmistakably downward.

What is the bank rate after the recent NRB policy shift?

The NRB bank rate 2025 has been adjusted downward in alignment with the broader monetary easing strategy. This is significant because the bank rate serves as the floor for lending rates across the commercial banking sector. Furthermore, when NRB lowers this, it essentially gives banks room to offer cheaper loans without hurting their own margins.

Here’s a quick breakdown:

| Rate Type | Previous Rate | New Rate (2025/26) | Change |

|---|---|---|---|

| Policy Rate | Higher baseline | Reduced | Downward adjustment |

| Bank Rate | Previous level | Lowered | Accommodative stance |

| Repo Rate | Previous level | Decreased | Easier liquidity |

| Deposit Collection Rate | Previous ceiling | Adjusted lower | Impacts savings returns |

Note: Specific percentages should be verified from official NRB sources as they may vary by exact policy instrument.

What This Means for Borrowers: Your Loans Just Got Cheaper

Here’s where things get interesting for anyone who’s been eyeing a new home, planning to expand their business, or even considering that personal loan for a much-needed vacation.

What impact will the lower interest rates by NRB have on borrowing in Nepal?

In simple terms: borrowing money is about to become more affordable. As a result, the Nepal lending rates 2025 are expected to trend downward as commercial banks adjust their interest rates to reflect NRB’s policy shift.

How does the rate cut influence home loans and personal loans in Nepal?

Let me paint you a picture. Say you’re looking at a home loan of NPR 50 lakh. Even a 1-2% reduction in interest rates can translate to savings of hundreds of thousands of rupees over the loan tenure. That’s real money—money you could redirect toward furnishing your new place or, I don’t know, actually enjoying your life instead of just servicing debt.

Personal loans? Same story. Whether you’re consolidating debt, funding education, or covering an emergency, lower rates mean you’re paying less for the privilege of borrowing money.

Who Benefits Most from Lower Lending Rates?

What sectors are expected to benefit the most from NRB’s rate cut?

Not all boats rise equally with this tide. Nevertheless, here’s who’s poised to gain the most:

- Real Estate and Construction: With housing loans becoming more affordable, expect renewed interest in property purchases. Consequently, developers who’ve been sitting on inventory might finally see movement.

- Small and Medium Enterprises (SMEs): These are the backbone of Nepal’s economy, and they’ve been credit-starved. Therefore, the effects of NRB interest rate cut on Nepal economy should be most visible here, with easier access to working capital and expansion loans.

- Agriculture: Farmers and agro-businesses have long complained about high borrowing costs. As a result, lower rates could incentivise investments in modern equipment and techniques.

- Manufacturing and Export-Oriented Industries: With cheaper credit, businesses can invest in capacity expansion and become more competitive.

- Stock Market Investors: The NRB rate cut and its effect on NEPSE shouldn’t be underestimated. Moreover, lower interest rates often drive investors away from fixed deposits toward equities, potentially boosting market activity.

The Flip Side: What About Your Savings?

Now, before you get too excited, there’s a catch. Actually, it’s not so much a catch as it is basic economics—but it’s something savers need to understand.

How will the lower deposit collection rate affect savers in Nepal?

Here’s the uncomfortable truth: if you’ve been relying on fixed deposits for returns, you’re about to earn less. Specifically, the NRB deposit collection rate has been adjusted downward, meaning banks will offer lower interest on deposits.

I know, I know. It feels like you’re being penalized for being responsible and saving money. However, here’s how to think about it: NRB is trying to encourage money to move out of savings accounts and into the economy through consumption and investment. It’s not personal; it’s policy.

The impact of lower deposit rates on Nepal savers means you might need to rethink your investment strategy. Accordingly, diversification becomes more important than ever. Consider exploring these investment alternatives and savings strategies:

- Exploring mutual funds or share market investments

- Looking into real estate opportunities

- Investigating bonds or other fixed-income alternatives

- Keeping only your emergency fund in traditional savings accounts

Inflation Watch: Is Cheaper Money Actually a Good Thing?

Are there risks of inflation due to NRB’s new lower rates?

This is the million-rupee question. When money becomes cheaper and more available, there’s always a risk that too much money chases too few goods, driving up prices. It’s Economics 101.

However, how lower rates affect inflation and economic growth in Nepal isn’t straightforward. In fact, NRB isn’t operating in a vacuum here. They’ve clearly calculated that the economy needs a stimulus more than it needs continued restraint. Current Nepal inflation and interest rates suggest there’s room for monetary easing without triggering runaway price increases.

The central bank is essentially betting that:

- The economy has enough slack (unused capacity) to absorb increased credit

- Supply chains can respond to increased demand

- Global commodity prices remain relatively stable

- NRB’s role in controlling inflation Nepal 2025 can be managed through other policy tools

It’s a calculated risk, but one that seems reasonable given current economic conditions.

Behind the Scenes: Liquidity and Credit Growth

How is NRB managing liquidity and credit growth with this policy change?

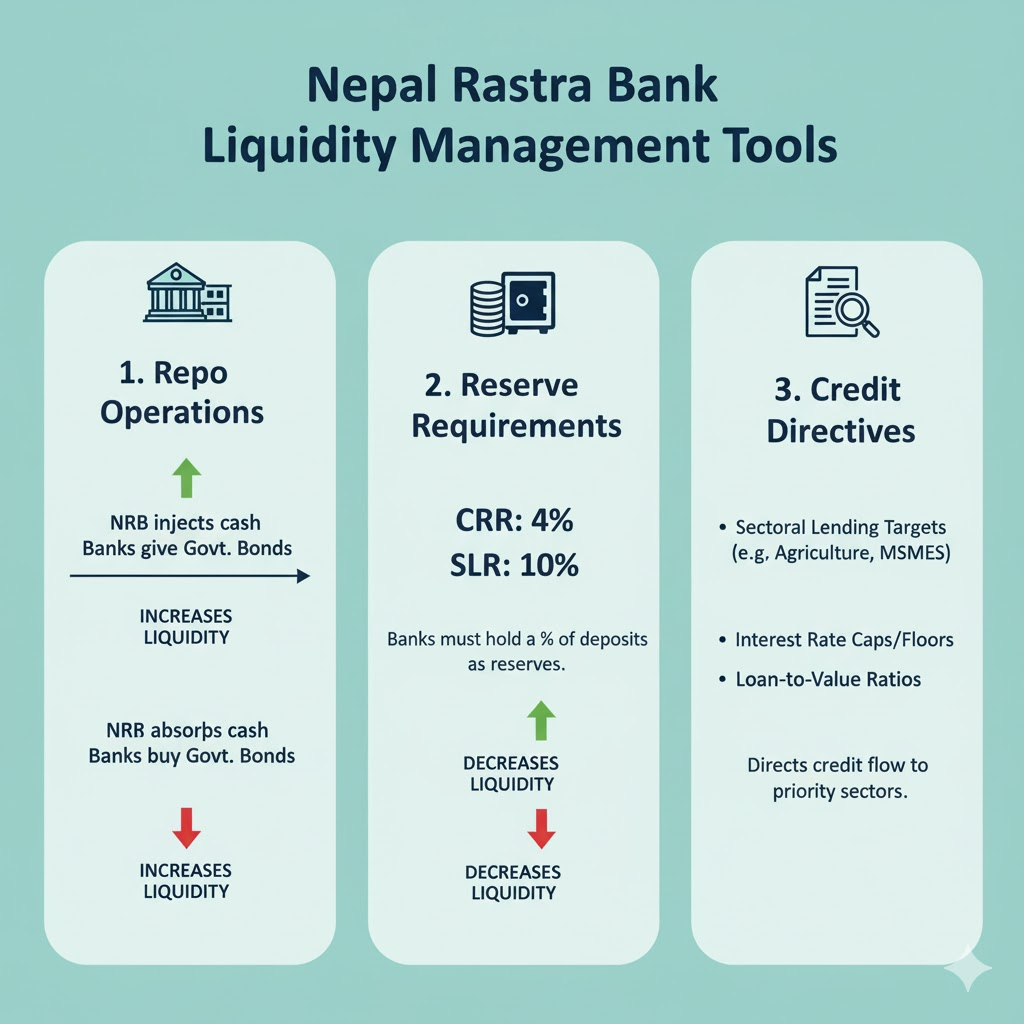

This is where NRB’s sophistication shows. It’s not just about cutting rates and hoping for the best. On the contrary, the NRB liquidity management after rate cut involves multiple moving parts:

The NRB repo rate—the rate at which commercial banks can borrow from the central bank—has been adjusted to ensure adequate liquidity in the banking system. Too little liquidity, and banks can’t lend even if they want to. Conversely, too much, and you risk inflation.

NRB is walking a tightrope here, using tools like:

- Open market operations

- Reserve requirement adjustments

- Targeted lending programs

- Sector-specific credit directives

It’s like conducting an orchestra—every instrument (policy tool) needs to play at the right time and volume.

Commercial Banks: How Are They Responding?

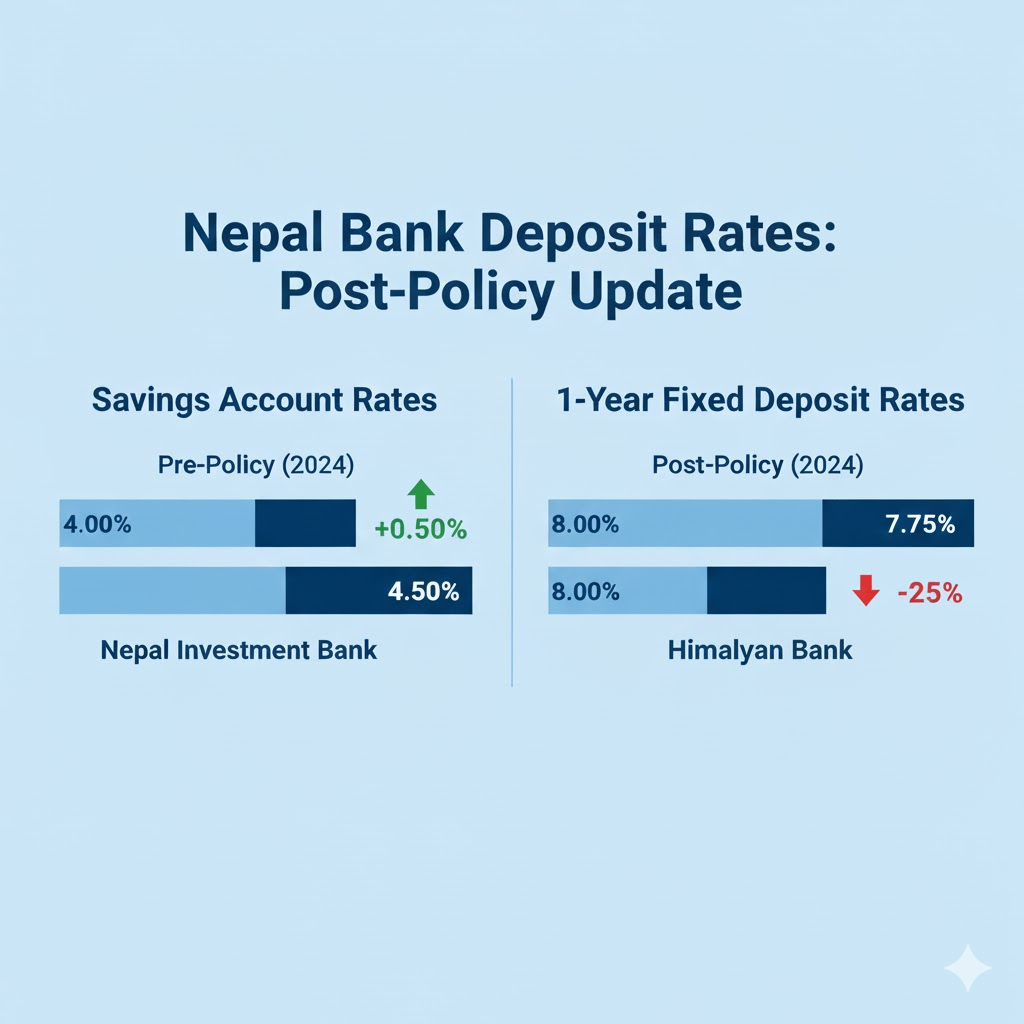

How NRB rate change affects commercial banks in Nepal is fascinating to watch unfold. Banks are in a tricky position. On one hand, lower rates mean their profit margins on loans shrink. On the other hand, if they don’t pass on the benefits to customers, they risk losing business to competitors who do.

The comparison of Nepal bank rates pre and post NRB policy shift will reveal winners and losers. Smart banks will use this as an opportunity to:

- Grow their loan portfolios while margins are still decent

- Attract quality borrowers who were previously priced out

- Diversify revenue through fees and services rather than just interest income

- Invest in technology to reduce costs and maintain profitability

Expect to see aggressive marketing from banks pushing home loans, business loans, and consumer credit products over the coming months.

Special Focus: What About Microfinance and Non-Banking Institutions?

NRB monetary policy on microfinance interest rates is crucial for financial inclusion. Microfinance institutions (MFIs) serve populations that commercial banks often overlook—small farmers, women entrepreneurs, rural businesses.

The policy shift should trickle down to these institutions, making Nepal Rastra Bank loan affordability 2025 a reality for more people. Nevertheless, MFIs typically have higher operating costs due to smaller loan sizes and more intensive servicing requirements, so their rates won’t drop as dramatically as commercial bank rates.

Similarly, non-banking financial institutions (NBFCs) are also impacted. They’ll need to adjust their lending rates to remain competitive while managing their own borrowing costs.

The Housing Market: Game On?

Let’s talk property. NRB monetary policy and housing loans have an almost immediate connection. Real estate has been in something of a slump in recent years, with high interest rates keeping many potential buyers on the sidelines.

The new policy could change that equation. Lower rates mean:

- Higher borrowing capacity for homebuyers

- Reduced EMI burdens on existing loan holders (if they refinance)

- Potential price adjustments as demand picks up

- Renewed developer confidence leading to new projects

If you’ve been house-hunting, the next 6-12 months might be interesting. But here’s my advice: don’t rush. Just because rates are lower doesn’t mean you should overextend yourself. Instead, buy what you can comfortably afford, not what banks are willing to lend you.

Business Owners: Time to Expand?

NRB lower rates impact on small businesses could be transformative—if businesses use the opportunity wisely.

I’ve talked to several SME owners who’ve been operating on tight margins, unable to invest in new equipment or expand operations because borrowing costs were prohibitive. Fortunately, this policy shift opens doors for business loans.

But—and this is important—cheap money isn’t a substitute for a solid business plan. If your business fundamentals aren’t sound, a lower interest rate isn’t going to save you. However, if you’ve got a viable expansion plan, now might be the time to pull the trigger.

Nepal economic growth and credit are intrinsically linked. When businesses can access affordable capital, they invest, hire, and grow. That’s the theory, anyway. Ultimately, the execution depends on entrepreneurs stepping up.

The NEPSE Connection: Stock Market Implications

Effect of NRB’s lower rates on foreign investment in Nepal and domestic stock market activity is worth monitoring.

Lower interest rates typically make equities more attractive relative to fixed-income investments. If deposit rates are barely beating inflation (or not even doing that), investors naturally look for alternatives. Subsequently, the stock market becomes one of those alternatives.

However—and I can’t stress this enough—don’t let monetary policy be your only reason for investing in stocks. The fundamentals of the companies you’re buying into matter far more than what NRB is doing with interest rates. Therefore, use the policy shift as context, not as a buy signal.

Dealing with Problem Loans: NRB’s Cleanup Strategy

NRB’s strategy to resolve non-performing loans (NPLs) is part of this broader policy picture. Banks have been sitting on bad loans that they’ve been reluctant to write off or restructure because it would hurt their balance sheets.

Lower rates and improved liquidity give banks breathing room to address these problem loans without panicking about their capital positions. Consequently, expect to see:

- Increased loan restructuring activity

- More aggressive recovery efforts on hopeless cases

- Stricter lending standards going forward (yes, even as rates drop)

- Better risk management practices

This cleanup is essential for long-term banking sector health. After all, you can’t build a sound financial system on a foundation of bad loans.

What You Should Actually Do with This Information

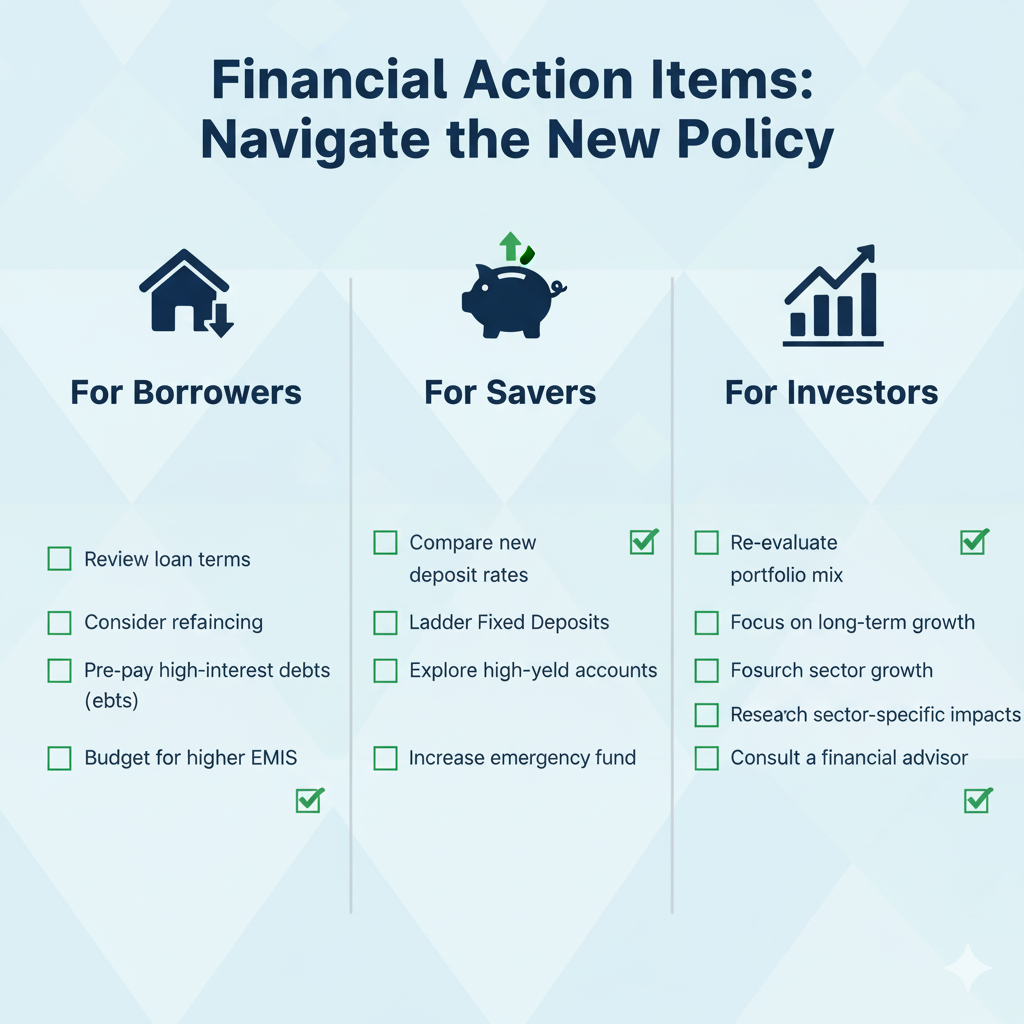

Alright, enough theory. Let’s get practical. Here’s your action plan based on NRB’s 2025 monetary policy update:

If You’re Planning to Borrow:

- Don’t rush immediately—banks will compete for business, so shop around

- Compare total cost of borrowing, not just interest rates

- Read the fine print on processing fees, prepayment penalties, etc.

- Consider fixed vs. floating rates based on your risk tolerance

- Calculate your actual repayment capacity before committing

If You’re a Saver:

- Review your investment allocation—are you too heavily in fixed deposits?

- Consider diversifying into mutual funds, bonds, or equities

- Maintain adequate emergency fund regardless of returns

- Don’t chase yield without understanding risk

- Talk to a financial advisor about appropriate strategies for your goals

If You’re a Business Owner:

- Evaluate expansion opportunities with realistic projections

- Don’t borrow just because it’s cheap—borrow because it makes business sense

- Consider refinancing existing high-interest debt

- Look at fixed-rate options if you want payment predictability

- Use this as a catalyst to improve financial management practices

If You’re a Homebuyer:

- Get pre-approved to understand your true buying power

- Factor in all costs (down payment, registration, furnishing)

- Don’t max out your borrowing capacity—leave buffer room

- Consider location and resale value, not just current price

- Think long-term about your needs and lifestyle

The Bigger Economic Picture

Let’s zoom out for a moment. This policy shift doesn’t exist in isolation. Rather, it’s part of Nepal’s broader economic strategy to:

- Stimulate growth after periods of uncertainty

- Improve credit availability to productive sectors

- Maintain financial stability while encouraging activity

- Balance inflation control with growth objectives

- Enhance Nepal economic growth and credit flows throughout the economy

The effects of NRB interest rate cut on Nepal economy will unfold over months and years, not days or weeks. Indeed, we’re talking about redirecting the flow of billions of rupees through the financial system. That takes time.

International Context: What’s Happening Globally?

It’s worth noting that Nepal doesn’t operate in a bubble. Global interest rate trends, commodity prices, remittance flows, and international trade all impact what NRB can and should do with monetary policy.

The effect of NRB’s lower rates on foreign investment in Nepal depends partly on global capital flows. If international investors see better risk-adjusted returns elsewhere, Nepal’s lower rates alone won’t attract them. Conversely, if global conditions are favorable and Nepal’s fundamentals are sound, this policy could be a catalyst for increased foreign direct investment.

Looking Ahead: What to Expect in Coming Months

Upcoming changes in Nepal’s bank lending rates will depend on several factors:

- How quickly commercial banks adjust their rates

- Credit demand from businesses and consumers

- Inflation trends and commodity prices

- Remittance inflows (still a huge factor for Nepal’s economy)

- Global economic conditions

- Government fiscal policy and spending

My educated guess? We’ll see a gradual decline in lending rates over the next 3-6 months, with some banks moving faster than others. Meanwhile, deposit rates will adjust more quickly because banks have immediate incentive to reduce their cost of funds.

The real test will be whether lower rates actually translate into increased economic activity. You can make money cheaper, but you can’t force people to borrow or businesses to invest if confidence is lacking.

Final Thoughts: Should You Be Excited About This?

Look, I get it. Monetary policy isn’t exactly a thrilling dinner conversation. Nevertheless, this NRB policy shift is genuinely significant for Nepal’s financial landscape.

If you’re a borrower, particularly for productive purposes like home purchase or business expansion, this is good news. Alternatively, if you’re a saver living off fixed deposit interest, you’ll need to adapt. If you’re just trying to make sense of where the economy is headed, consider this a signal that the central bank is prioritising growth and credit availability.

The Nepal Rastra Bank’s monetary policy for 2025/26 isn’t perfect—no policy ever is. There are risks, particularly around inflation and potential asset bubbles if things overheat. However, it’s a reasonable response to current economic conditions.

My advice? Stay informed, but don’t obsess. Use this policy shift as an opportunity to review your own financial situation. Are you saving enough? Borrowing wisely? Investing appropriately for your goals and risk tolerance?

The big policy shifts happen at NRB headquarters in Baluwatar. But the real impact happens in your daily financial decisions. Make them count.

Take Action: What’s Your Next Move?

Here’s what I want you to do after reading this:

- Review your current loans – Can you refinance at better rates? Should you?

- Assess your savings strategy – Is it still appropriate given lower deposit rates?

- Talk to your bank – Ask specific questions about how these policy changes affect your products

- Educate yourself – Visit the official NRB website for detailed policy documents

- Share this information – Help friends and family understand what’s happening to their money

Remember, financial literacy isn’t about understanding every technical term. Rather, it’s about knowing enough to make informed decisions that serve your best interests.

The Nepal Rastra Bank has made its move. Now it’s your turn.

Quick Reference: Key Resources

- Official NRB Monetary Policy Document 2025/26: Check the latest updates directly from Nepal Rastra Bank

- Compare Bank Rates: Use online comparison tools to find best loan and deposit rates

- Financial Calculators: Use EMI calculators to understand true borrowing costs

- Consumer Protection Programs: Know your rights under NRB’s consumer protection framework

- NRB Financial Inclusion Initiatives: Programs to enhance financial access post-rate cut

- NEPSE Investment Platforms: Explore stock market opportunities with lower rates

- Latest Nepal Banking News: Stay updated on banking sector developments

The bottom line? NRB’s policy shift is creating opportunities and challenges. Ultimately, how you respond will determine whether this change helps or hurts your financial situation. Choose wisely, act deliberately, and always—always read the fine print.

Your money, your rules. But now you’ve got better information to make those rules work for you.

What’s your take on NRB’s rate cut? Are you planning to take advantage of lower borrowing costs, or are you worried about reduced returns on savings? Drop a comment below and let’s discuss I’d genuinely love to hear your perspective.