Understanding the Fixed Deposit Interest Rate in Nepal

Picture this: You’ve finally saved up a decent chunk of money, and it’s just sitting there in your regular savings account, earning peanuts. Meanwhile, your friend casually mentions they’re getting double the returns on their fixed deposit. Frustrating, right?

Here’s the thing—most of us in Nepal treat fixed deposit interest rate in Nepal offerings like that reliable but boring cousin at family gatherings. We know they’re there, we know they’re safe, but we never really pay attention to what they’re offering. And that’s exactly where we’re leaving money on the table.

Moreover, I’ve spent years navigating Nepal’s banking landscape, and let me tell you: not all fixed deposits are created equal. In fact, the difference between the highest and lowest interest rates can literally mean thousands of rupees over a few years. Therefore, whether you’re a first-time investor or someone looking to optimize your existing FDs, buckle up. We’re about to dive deep into everything you need to know about choosing the best fixed deposit interest rate in Nepal.

Understanding Fixed Deposits in Nepal: Beyond the Basics

Before we get into the nitty-gritty of rates and comparisons, let’s establish what we’re actually talking about here.

A fixed deposit (FD) is essentially you lending money to a bank for a predetermined period—could be 3 months, could be 5 years—and in return, the bank pays you interest at a fixed rate. Simple enough, right?

The beauty of FDs lies in their predictability. Unlike the stock market that can give you anxiety attacks at 2 AM, or real estate investments that tie up your money for years, FDs are straightforward. In other words, you know exactly how much you’ll get back and when.

But here’s where it gets interesting. The Nepal bank interest rate today isn’t just one number—it’s a complex ecosystem influenced by everything from Nepal Rastra Bank policies to individual bank strategies. And if you’re smart about it, you can leverage this complexity to your advantage.

Current Fixed Deposit Interest Rate in Nepal: What’s the Latest?

Let’s talk numbers, because that’s what you’re really here for when searching for fixed deposit interest rate in Nepal.

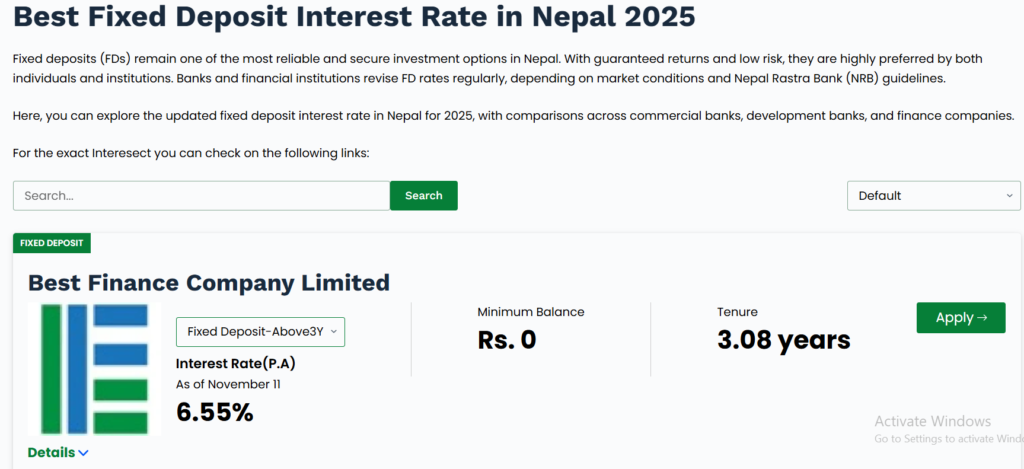

As of late 2025, the current fixed deposit rates Nepal today are sitting in a pretty sweet spot. Furthermore, thanks to Nepal Rastra Bank’s monetary policies and increased competition among commercial banks, we’re seeing rates that actually make FDs attractive again.

Here’s what the landscape looks like:

Standard Fixed Deposit Rates:

- 3-month FDs: 2.5% – 3.0% per annum

- 6-month FDs: 3.0% – 3.5% per annum

- 1-year FDs: 3.25% – 4.0% per annum

- 3-year FDs: 3.5% – 5.0% per annum

- 5-year FDs: 4.0% – 5.5% per annum

But wait—these are just the baseline rates. The real magic happens when you know where to look and how to negotiate.

Top Banks Offering the Best Fixed Deposit Interest Rate in Nepal

Not all banks in Nepal play the same game when it comes to fixed deposit interest rate in Nepal offerings. In fact, some are aggressive with their offers, while others bank on their reputation (pun intended).

Top performers in the FD interest rate game:

Nabil Bank Fixed Deposit has consistently been a frontrunner, offering rates between 3.25% to 3.75% depending on your deposit tenure and amount. Additionally, they’ve built a reputation for being reliable, and their digital banking infrastructure makes managing your FD remarkably hassle-free.

Nepal Bank Limited isn’t just riding on its legacy as Nepal’s first bank—they’re actively competing with attractive rates, especially on their longer-tenure deposits. Plus, they’ve got special schemes that we’ll discuss in a bit.

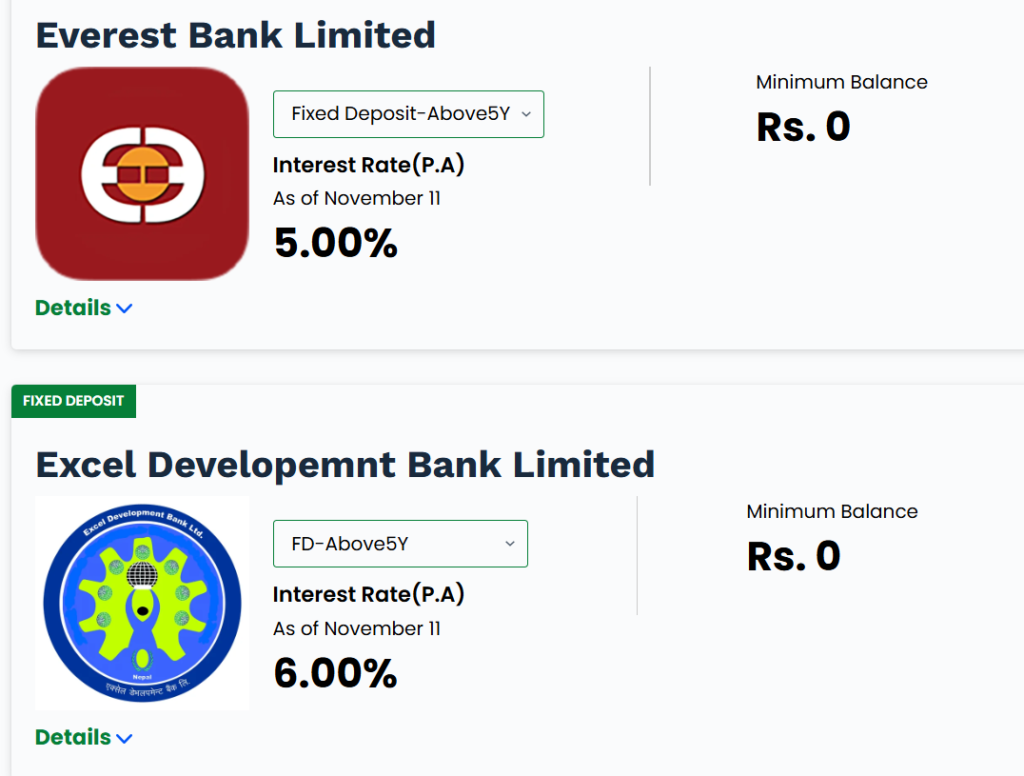

Everest Bank and Nepal Investment Mega Bank have been particularly aggressive in 2025, occasionally offering promotional rates that can go up to 5.5% for certain tenure combinations.

Here’s a pro tip I learned the hard way: don’t just look at the advertised rate. Instead, call the bank, talk to a relationship manager, and if you’re depositing a substantial amount (think 10 lakhs or more), negotiate. Banks have flexibility, especially if you’re bringing in fresh money.

Nepal Rastra Bank’s Role in Fixed Deposit Interest Rate in Nepal

You might wonder why we keep mentioning the Nepal Rastra Bank interest rate. Here’s why it matters to your wallet.

Nepal Rastra Bank (NRB) is like the conductor of Nepal’s banking orchestra. Specifically, when NRB adjusts its base rate or repo rate, it creates a ripple effect across all commercial banks. The Nepal Rastra Bank base rate impact is direct and immediate—when NRB raises rates, banks typically follow suit with their deposit rates (and loan rates, but that’s another story).

Currently, NRB has maintained a relatively stable monetary policy, which is why we’re seeing consistent FD rates across the board. However, here’s what you need to watch: NRB’s quarterly monetary policy announcements. These can signal upcoming changes in interest rates, giving you a window to either lock in current rates or wait for better ones.

I remember back in 2023 when NRB tightened monetary policy—FD rates shot up within weeks. Consequently, those who moved quickly locked in rates above 6% for 3-year terms. Those were the days.

Fixed vs. Floating Interest Rates: What’s Your Play?

This is where things get philosophical. The difference between fixed and floating interest rates in Nepal isn’t just technical—it’s about your risk appetite and market outlook.

Fixed Interest Rates: You lock in a rate for the entire tenure. On one hand, if rates go down tomorrow, you’re still getting your agreed-upon return. On the other hand, if rates skyrocket, well, you’re stuck with what you signed up for. It’s the financial equivalent of commitment.

Floating Interest Rates: Your returns fluctuate based on the bank’s base rate, which is influenced by NRB policies. More flexibility, but also more uncertainty.

My take? In the current Nepal banking environment, fixed rates make more sense for most people. Why? Because NRB has signaled stable monetary policy for the near future, and the predictability of fixed rates lets you plan better. Moreover, you avoid the anxiety of watching rates fluctuate.

However, if you’re the type who loves riding market waves and you’re depositing for shorter tenures (under 1 year), floating rates might offer you opportunities to benefit from rate increases.

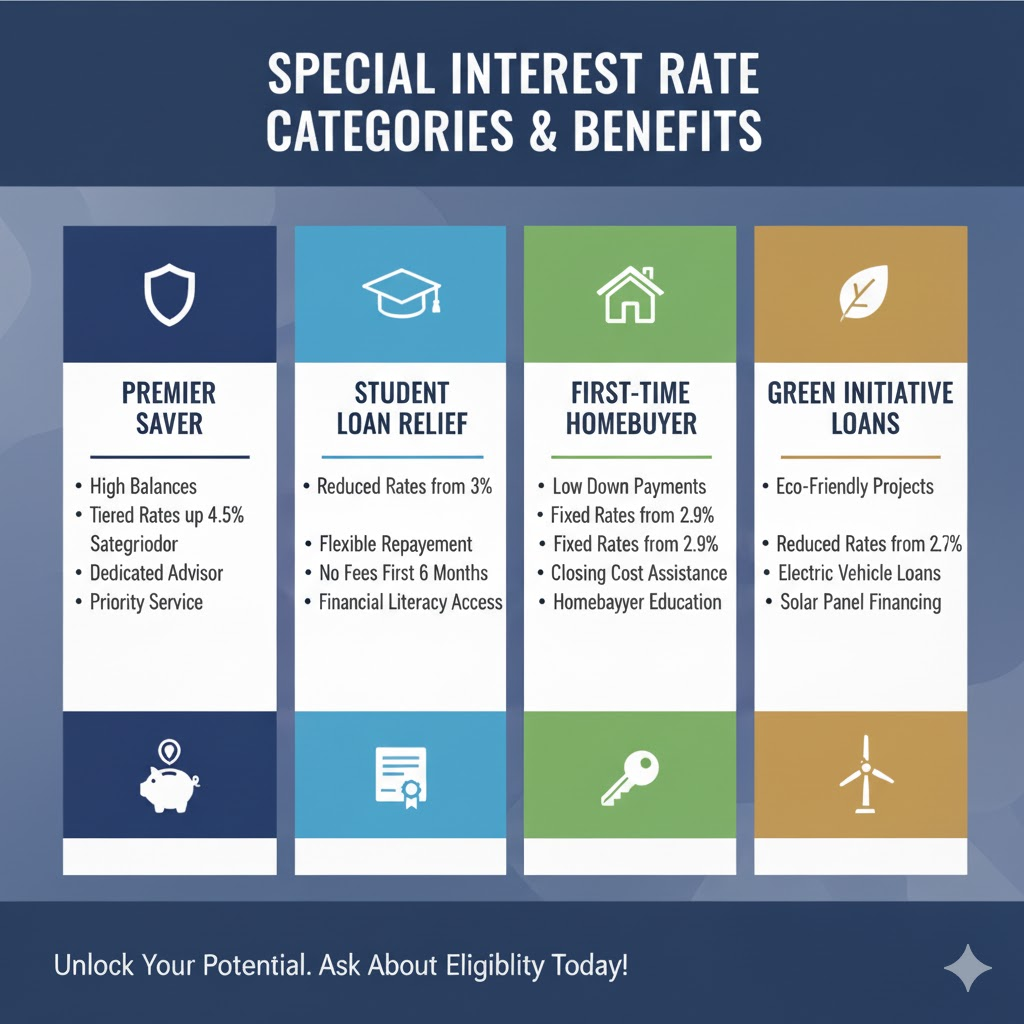

Special Interest Rates: The Hidden Opportunities

Here’s something most people miss entirely when looking for the best fixed deposit interest rate in Nepal: special interest rates for women or senior citizens in Nepal banks. These aren’t just feel-good initiatives—they’re legitimate ways to earn extra returns.

Women’s Special Saving Accounts: Banks like Nepal Bank Limited offer their Women’s Special Saving account with 3.00% interest—that’s 0.25% higher than regular savings accounts. While not technically a fixed deposit, it’s worth knowing about because some banks extend special rate considerations to women opening FDs as well.

Senior Citizen Deposit Rates: If you’re above 60 (or have parents who are), this is your golden ticket when comparing fixed deposit interest rate in Nepal options. Most Nepalese banks offer an additional 0.5% to 1% on top of standard FD rates for senior citizens. That’s not pocket change—on a 20 lakh deposit over 3 years, that extra percentage point translates to an additional 60,000 rupees.

Nepal Bank’s Diamond Saving Account is another interesting product—while it’s a savings account offering 3.00% (higher than regular saving deposit’s 2.75%), it demonstrates how banks tier their products based on customer segments.

How to Compare Fixed Deposit Interest Rate in Nepal (The Smart Way)

Okay, so you’re convinced that shopping around matters. But how can I compare interest rates among different banks in Nepal today without losing your mind?

Here’s my systematic approach to finding the best fixed deposit interest rate in Nepal:

Step 1: Create Your Comparison Matrix

Make a simple spreadsheet with these columns:

- Bank name

- Minimum deposit amount

- Interest rate by tenure (3M, 6M, 1Y, 3Y, 5Y)

- Interest payment frequency (monthly, quarterly, maturity)

- Premature withdrawal penalty

- Special rates (if applicable)

- Tax implications

Step 2: Use Official Resources

Where can I find official updates on Nepal bank interest rates? Great question. Here’s your starter pack for comparing fixed deposit interest rate in Nepal:

- nrb.org.np: The Nepal Rastra Bank website publishes aggregated data on commercial bank interest rates. It’s dry as toast but incredibly accurate.

- Individual bank websites: Most major banks update their interest rate cards monthly

- Financial comparison websites: Several Nepali fintech platforms now aggregate this data in user-friendly formats

Additionally, many banks now have mobile apps where you can check current rates instantly.

Step 3: Factor in the Intangibles

Interest rate isn’t everything when choosing the best fixed deposit interest rate in Nepal. Consider:

- Bank’s financial stability (check their quarterly reports)

- Branch accessibility (important if you need physical interactions)

- Digital banking capabilities (life’s too short for long bank queues)

- Customer service reputation (trust me, you’ll appreciate this when issues arise)

Furthermore, check online reviews and ask friends about their experiences with specific banks.

Step 4: Calculate the Actual Returns

Use an FD calculator to compute the maturity amount after tax. Remember, interest income is taxable in Nepal, and banks deduct TDS (Tax Deducted at Source). The Nepal bank fixed deposit interest rate you see advertised is pre-tax—your actual return will be lower.

For instance, if you’re in the highest tax bracket and you see a 4% FD rate, your effective post-tax return drops to around 3.6%. Still better than a savings account, but the math matters.

Nevertheless, FDs remain one of the safest investment options available.

Breaking Down the Best Bank Interest Rates in Nepal 2025

Let’s get granular with best bank interest rates in Nepal 2025 across different product categories. Understanding these helps you maximize your fixed deposit interest rate in Nepal returns.

Top Fixed Deposit Products:

- Rates: 3.25% – 3.75% depending on tenure

- Minimum deposit: Rs. 1,000

- Why it’s good: Flexible terms, strong reputation, excellent digital banking

- Best for: Conservative investors wanting reliability

2. Nepal Bank Normal Saving Deposit (okay, not an FD, but hear me out)

- Rate: 2.75% p.a.

- Why it matters: Provides liquidity while earning reasonable returns

- Best for: Emergency funds that need accessibility

3. Standard Chartered Fixed Deposit

- Rates: Competitive with market leaders

- Minimum deposit: Varies by tenure

- Why it’s good: International banking standards, robust security

- Best for: NRIs and those wanting international banking exposure

Consequently, diversifying across multiple banks can help you optimize returns.

For Loan Needs Against Your FD:

NIBL Loan Against Fixed Deposit Interest rate: Typically Base Rate + 2-3%

Here’s a clever move: If you need quick liquidity but don’t want to break your FD (and lose the interest), take a loan against it. The loan against fixed deposit interest rate Nepal is usually lower than personal loan rates, and your FD continues earning interest. It’s like having your cake and eating it too.

Similarly, this strategy works well during financial emergencies.

Nepal Bank Loan Interest Rates: The Other Side of the Coin

While we’re focusing on deposits, understanding the Nepal bank loan interest rate landscape helps you see the bigger picture of how banks operate.

Current Loan Interest Rate Ranges:

Personal Loans:

- Nepal Bank: BR+2.5% to 4%

- Rate range: Approximately 8-10% per annum

- Best for: Debt consolidation, personal needs

Home Loans:

- Nepal Bank starting at BR+2.42%

- Fixed and floating options available

- Housing loan interest rates from Nepal banks remain among the most competitive loan products

- Range: 7-9% per annum

Auto Loans:

- Nepal Bank: BR+0.5% to 2.5%

- Auto loan interest rates Nepal 2025 are particularly attractive right now

- Range: 8-10% per annum

Education Loans:

- Nepal Bank: 2% to 3.5%

- Subsidized rates make education financing accessible

- Range: 5-8% per annum

Business Loans:

- Term loans: Variable based on business type and collateral

- Working capital loans: Higher rates but flexible terms

- Small and Medium Enterprise loans: Special schemes with favorable conditions

Agricultural Loans:

- Agricultural loan interest rates Nepal 2025 remain subsidized

- Government backing makes these highly affordable

- Range: 3-7% per annum

The interesting thing about loan rates? They give you insight into bank profitability margins. If a bank’s loan rates are high but deposit rates are low, they’re making a killing on the spread. Conversely, banks with competitive deposit rates and reasonable loan rates often have better operational efficiency—and that’s where you want your money.

Therefore, always compare both deposit and loan rates when choosing your primary bank.

Saving Account Interest Rates vs. Fixed Deposits: The Real Talk

Let’s address the Nepal saving account interest rate situation because this is where most people start before moving to fixed deposit interest rate in Nepal products.

Current Savings Account Landscape:

- Standard accounts: 2.0% – 2.75% per annum

- Premium accounts: 3.0% – 3.5% per annum

- Interest rates on saving deposits in Nepal banks have improved, but still lag behind FDs

Here’s my honest take on the savings account vs. FD debate:

Keep in Savings Accounts:

- 3-6 months of emergency expenses

- Money you need access to within 30 days

- Funds for ongoing monthly expenses

Move to Fixed Deposits:

- Money you won’t need for at least 3 months

- Funds earmarked for specific goals (down payment, vacation, education)

- Retirement savings (if you’re not into mutual funds or stocks)

Meanwhile, the Nepal commercial bank interest rate differential between savings and FDs can range from 0.5% to 2%—that’s significant when compounded over time.

I personally follow a 60-40 rule: 60% of my liquid savings in FDs with staggered maturity dates (more on this in a moment), 40% in high-yield savings accounts for liquidity. Adjust based on your risk tolerance and cash flow needs.

Advanced Strategies: Making Your FD Work Harder

Alright, you’ve got the basics down. Now let’s talk strategy—the stuff that separates savvy savers from the rest.

The Laddering Technique

Instead of putting all your money in one 3-year FD, split it across multiple FDs with different maturity dates. For example, with 10 lakhs:

- 2 lakhs in a 6-month FD

- 2 lakhs in a 1-year FD

- 3 lakhs in a 2-year FD

- 3 lakhs in a 3-year FD

This gives you regular liquidity opportunities and protects you from interest rate changes. When the 6-month FD matures, you can either renew it or take advantage of potentially better rates elsewhere.

The Sweep-In Option

Some banks offer linked accounts where excess savings automatically “sweep into” FDs, earning you FD rates while maintaining savings account liquidity. It’s like automatic optimization—your money works harder without you lifting a finger.

Tax Planning with FDs

While FD interest is taxable, you can be strategic:

- Distribute FDs across family members (spouse, parents) who are in lower tax brackets

- Time your FD maturities to fall in financial years when you expect lower income

- Consider tax-saving FDs (though these come with 5-year lock-ins)

The Negotiation Game

Here’s something banks don’t advertise: rates are often negotiable, especially for deposits above 10 lakhs. I’ve personally negotiated an extra 0.25% on a large FD by simply asking. The worst they can say is no, and the best case? You earn thousands more over the tenure.

Red Flags: When That “Amazing” Rate Is Too Good to Be True

Not all glittering interest rates are gold. Watch out for:

Unrealistic Rates: If a bank is offering rates significantly higher than market leaders (like 8% when everyone else is at 4%), investigate thoroughly. It might signal financial distress or aggressive deposit mobilization before regulatory issues.

Hidden Charges: Some banks advertise high rates but bury charges for premature withdrawal, account maintenance, or processing. Read the fine print. All of it.

Forced Product Bundling: “Get 5% FD rate if you also take our insurance policy!” Run. These bundled products almost never work in your favor.

Unclear Terms: If you can’t understand the terms and conditions after a thorough read, or if bank staff give vague answers about penalties and maturity procedures, consider it a red flag.

The Digital Revolution: How Technology Is Changing FD Investing

Nepal Investment Mega Bank’s Digital Saving account and similar products from Global IME Bank represent a shift in how we interact with banking products.

You can now:

- Open FDs entirely online without visiting a branch

- Track your FD portfolio through mobile apps

- Set up automatic renewals

- Receive real-time maturity notifications

- Compare rates across banks using aggregator platforms

The Nepal bank loan interest rate comparison tools available online have made transparency unprecedented. Twenty years ago, you had to physically visit banks to compare rates. Now? It takes 10 minutes on your phone.

This digital transformation is also pushing banks to be more competitive with their rates because customers can easily compare and switch.

Recurring Deposits: The Disciplined Saver’s Friend

While we’re mainly discussing fixed deposits, let’s briefly touch on interest rates on recurring deposits in Nepal, because they serve a different purpose.

Recurring Deposits (RDs):

- Invest a fixed amount monthly (say, Rs. 5,000)

- Lock in an interest rate similar to FDs

- Build a corpus through disciplined monthly saving

- Current rates: 3.0% – 4.5% depending on tenure

RDs are brilliant if you’re not sitting on a lump sum but want to build wealth systematically. Nepal Bank’s Recurring Deposit products offer competitive rates, and the forced saving discipline is worth its weight in gold.

Think of it as automated wealth building—you commit to a monthly amount, and before you know it, you’ve built a substantial emergency fund or down payment.

Special Mention: Pensioner-Friendly Products

Nepal Bank Pensioner Loan and similar products acknowledge that retirees have unique financial needs. Many banks offer:

- Higher FD rates for pensioners

- Loans against pension income at attractive rates

- Simplified documentation

- Monthly interest payout options (instead of lump sum at maturity)

If you’re retired or planning for retirement, these products deserve serious consideration. The monthly interest payout option, in particular, can supplement pension income beautifully.

How to Actually Choose: Your Step-by-Step Action Plan

Alright, enough information overload. Here’s what you actually do:

Step 1: Define Your Goal Why are you investing in an FD? Emergency fund? Down payment in 2 years? Retirement corpus? Your goal determines your tenure.

Step 2: Calculate Your Amount How much can you comfortably lock away? Never put money in FDs that you might need in an emergency—that’s what savings accounts are for.

Step 3: Shortlist Banks Based on our discussion, shortlist 3-5 banks. Consider:

- Interest rates for your target tenure

- Bank’s reputation and stability

- Convenience (branch access, digital banking)

- Special rates you qualify for

Step 4: Run the Numbers Use FD calculators to see actual maturity amounts post-tax. Sometimes a 4% rate at Bank A beats a 4.2% rate at Bank B if Bank A has better interest compounding or lower charges.

Step 5: Read Reviews Check online forums, ask friends about their experiences. Customer service matters when you’re dealing with your hard-earned money.

Step 6: Make the Move Once decided, act quickly—rates can change. Most banks allow online FD booking now, making the process painless.

Step 7: Document Everything Keep copies of your FD receipts, terms and conditions, and set calendar reminders for maturity dates. Sounds basic, but you’d be surprised how many people forget.

The Tax Angle: What Actually Hits Your Pocket

Let’s get real about taxes because the Nepal bank interest rate today that you see advertised isn’t what you actually take home.

How FD Interest Is Taxed:

- Interest income is added to your total income

- Taxed as per your income tax slab

- Banks deduct TDS (usually 5-15% depending on amount)

- You need to report FD interest in your annual tax returns

Quick Example: FD of Rs. 10,00,000 at 4% for 1 year

- Gross interest: Rs. 40,000

- TDS @ 5%: Rs. 2,000

- Net interest received: Rs. 38,000

- Additional tax if you’re in a higher bracket: Variable

The point? Factor in taxes when comparing FD returns to other investment options. Sometimes a tax-free option (if any) or tax-efficient investment might give you better post-tax returns even with lower pre-tax rates.

The Bottom Line: Making Your Money Work Smarter

Look, I get it. Fixed deposits aren’t sexy. They won’t give you the thrill of stock market gains or the pride of property ownership. But here’s what they will give you: predictable returns, capital safety, and peace of mind.

In Nepal’s current economic climate, with best bank interest rates in Nepal 2025 hovering in the 3-5% range, FDs serve as an excellent foundation for your financial portfolio. They’re not your only investment, but they should absolutely be part of your strategy.

The key takeaway? Don’t be passive. Nepal bank interest rate today varies significantly across institutions, tenures, and customer categories. An extra 0.5% might not sound like much, but over a 5-year FD of 20 lakhs, that’s a difference of 50,000 rupees—enough for a decent vacation or several months of emergency expenses.

Do your homework. Compare rates. Negotiate when possible. Ladder your FDs. Take advantage of special category rates if you qualify. And most importantly, match your FD strategy to your financial goals.

The banks that are winning customer deposits right now—Nabil, Nepal Bank, Everest Bank, Standard Chartered—are doing so because they understand that informed customers demand transparency and competitive rates. Be that informed customer.

Your Next Steps

Ready to make your money work harder? Here’s what to do right now:

- Calculate how much you can comfortably invest in FDs without compromising liquidity

- Visit the Nepal Rastra Bank website and 2-3 bank websites to compare current rates

- Call the banks you’re interested in and ask about current promotional rates or special categories you might qualify for

- Open your first (or next) fixed deposit with your chosen bank

- Set calendar reminders for maturity dates and rate review periods

Remember, the best time to start optimizing your returns was yesterday. The second-best time is today.

Your financial future isn’t built in dramatic moves—it’s built in consistent, informed decisions. And choosing the right fixed deposit interest rate? That’s one of those decisions that compounds beautifully over time.

Now stop reading and start depositing. Your future self will thank you.

Frequently Asked Questions: Your Burning Questions Answered

Disclaimer: Interest rates mentioned in this article are based on data available as of November 2025 and are subject to change. Always verify current rates with respective banks before making investment decisions. This article is for informational purposes and should not be considered financial advice. Consult a qualified financial advisor for personalized recommendations.

Want to stay updated on the latest interest rates in Nepal? Bookmark this page and check back monthly for updates. Drop a comment below sharing which bank you’ve had the best FD experience with—your insights help fellow readers make better decisions.